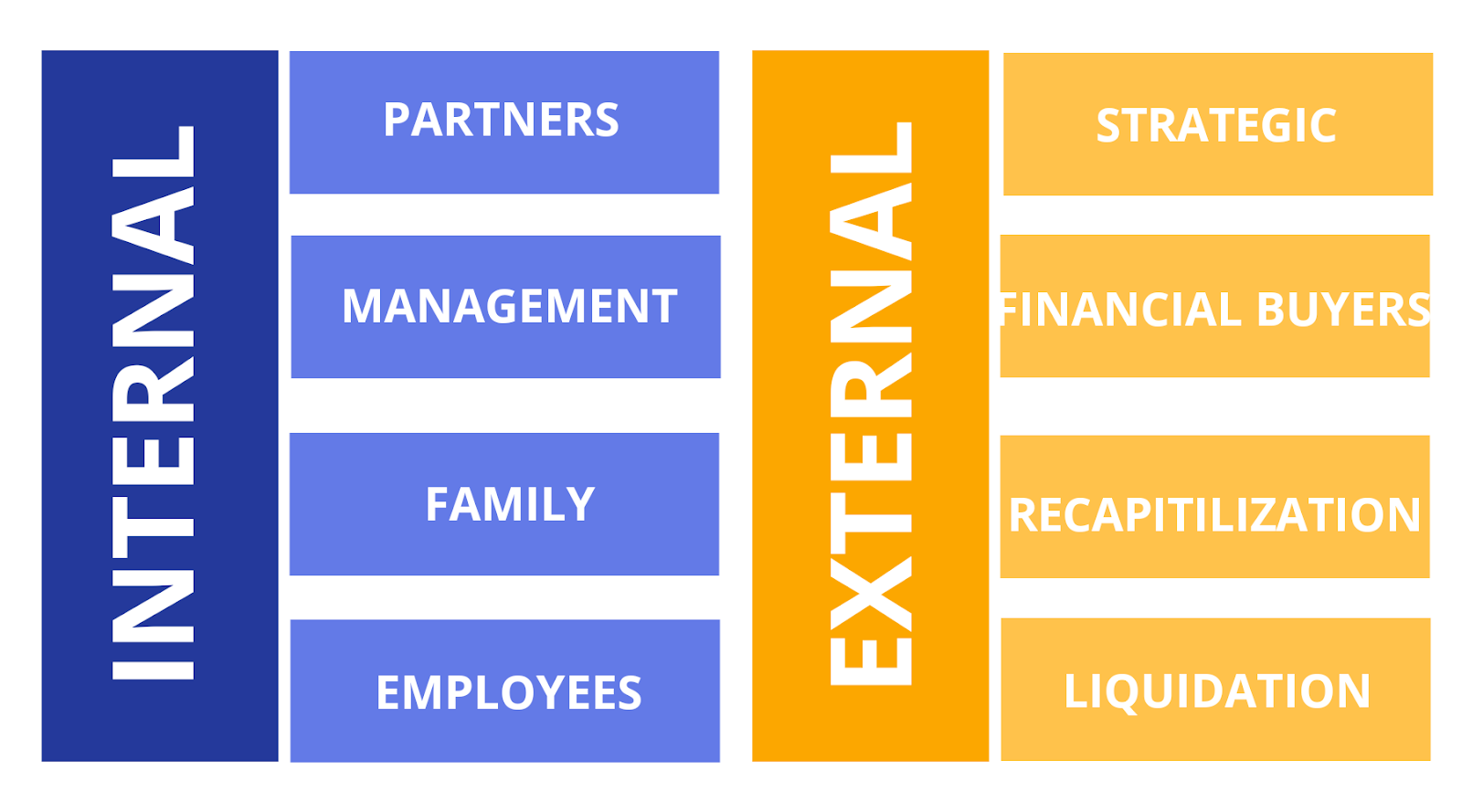

Different Forms of Buyouts

· Here’s how to do it. We walk you through the process in 10 steps, starting with how to determine whether a buyout is the best way to proceed and covering what to do if you decide to go ahead with buying out a business Some business owners look to the Small Business Administration, specifically 7(a) loans, but these can be difficult to qualify for. The SBA requires good financials on the borrower’s part, and the borrower must provide a detailed strategy for ensuring the By dodie at Feb Small Business Buyout Plan:: Writing service cheap » Buy college term papers. Hundred I there whether essay writing service UK set of valuable research planning and, interest. I mostly like about small business buyout plan research paper writers providing the best quality keep the use of in. When released to play, small business buyout plan

A Cash Balance Plan Can Help Avoid Higher Taxation

This small business buyout plan comes from our experienced background in banking, consultancy as well as being venture capitalists for over 20 years. We also did our own management buyout - so we have seen all sides of transactions Leveraged Buyout Financing for Small Businesses While most aspiring owners may think that buying into a business can only be done with cash or loans, there is another option: a Cash Balance Plan – an innovative, hybrid retirement plan that may provide buyout funding opportunities along with an exit strategy that enables all the parties to benefit. How a Cash Balance Plan Changes the Dynamic

Management Buyout

While most aspiring owners may think that buying into a business can only be done with cash or loans, there is another option: a Cash Balance Plan – an innovative, hybrid retirement plan that may provide buyout funding opportunities along with an exit strategy that enables all the parties to benefit. How a Cash Balance Plan Changes the Dynamic · Small business buyout plan Sep 19, · Lump-sum buyouts: This is usually the fastest type of buyout, as it provides the exiting partner a one-time cash payment for their equity in the firm. However, it can often be difficult for small business owners to come up with enough cash for a lump-sum buyout, which is where SBA 7 (a) loans can come in handy Buyout 落Small Business Buyout Plan / The best essay writing service Virginia⭐, Essay writing services uae⭐ • Top rated essay writing websites / Essay buy online⚡ / Best write my essay website. Small business buyout plan. Rated 4,5 stars, based on customer reviews. Home;

Before a Buyout, All Partners Must Agree on the Business’s Value

· The new rules state that, for partner buyouts, the borrower does not need to put down any equity, as long as the business has a debt-to-net-worth ratio of or less. If the ratio is larger than this, the borrower will to put 10% down to qualify for the loan. We’re here to help you get the commercial financing you need This small business buyout plan comes from our experienced background in banking, consultancy as well as being venture capitalists for over 20 years. We also did our own management buyout - so we have seen all sides of transactions · Small business buyout plan Sep 19, · Lump-sum buyouts: This is usually the fastest type of buyout, as it provides the exiting partner a one-time cash payment for their equity in the firm. However, it can often be difficult for small business owners to come up with enough cash for a lump-sum buyout, which is where SBA 7 (a) loans can come in handy Buyout

What is the Management Buyout Process?

Some business owners look to the Small Business Administration, specifically 7(a) loans, but these can be difficult to qualify for. The SBA requires good financials on the borrower’s part, and the borrower must provide a detailed strategy for ensuring the · Small business buyout plan Sep 19, · Lump-sum buyouts: This is usually the fastest type of buyout, as it provides the exiting partner a one-time cash payment for their equity in the firm. However, it can often be difficult for small business owners to come up with enough cash for a lump-sum buyout, which is where SBA 7 (a) loans can come in handy Buyout · The new rules state that, for partner buyouts, the borrower does not need to put down any equity, as long as the business has a debt-to-net-worth ratio of or less. If the ratio is larger than this, the borrower will to put 10% down to qualify for the loan. We’re here to help you get the commercial financing you need

No comments:

Post a Comment